I previously wrote about the denomination effect, where people spend the coins faster than banknotes because coins are perceived as ‘smaller’, creating fewer psychological barriers.

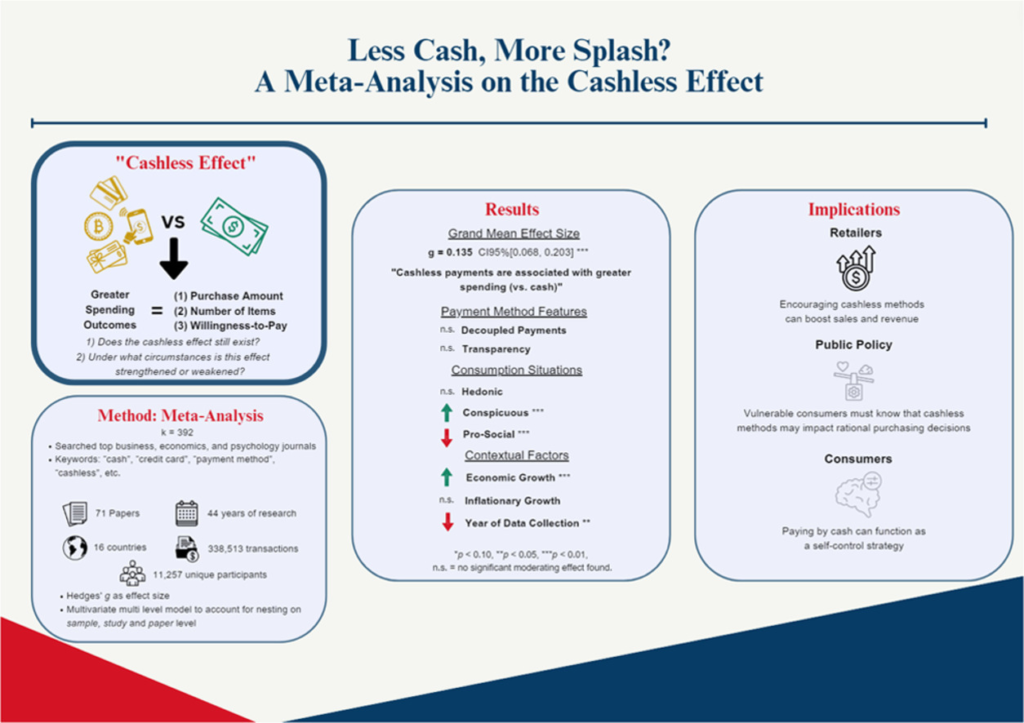

This raised the question of whether increased “financial abstraction” leads to higher spending, too. Indeed, research confirms that the lower the payment transparency, the greater the spend. This is the cashless effect, and its impacts are summarised in this graphic from the linked meta-study:

The findings show that the cashless effect is more pronounced when it comes to conspicuous consumption (wealth or status displays), weaker in prosocial scenarios (like tipping and charity), and not particularly observed for hedonistic purchases (emotional vs. practical purchasing).

The implications are significant: a ‘cashless society’ would likely disproportionately affect vulnerable consumers and the ‘unbanked’. So we should pay in cash to amplify the ‘pain of payment’ and curb impulse purchases, but companies should increase levels of abstraction to boost sales.

A related study finding that the lower the payment transparency, the greater the consumption (full text), showed that increasing the abstraction level, making the cost less apparent (“decreasing salience on the amount spent”), and delaying resulting financial outflows all drive higher consumption.

Just image the perfect storm of a prepaid loyalty card loaded monthly with store-specific ‘credits’!